Стоит ли играть +в вулкан

Стоит ли играть +в вулкан

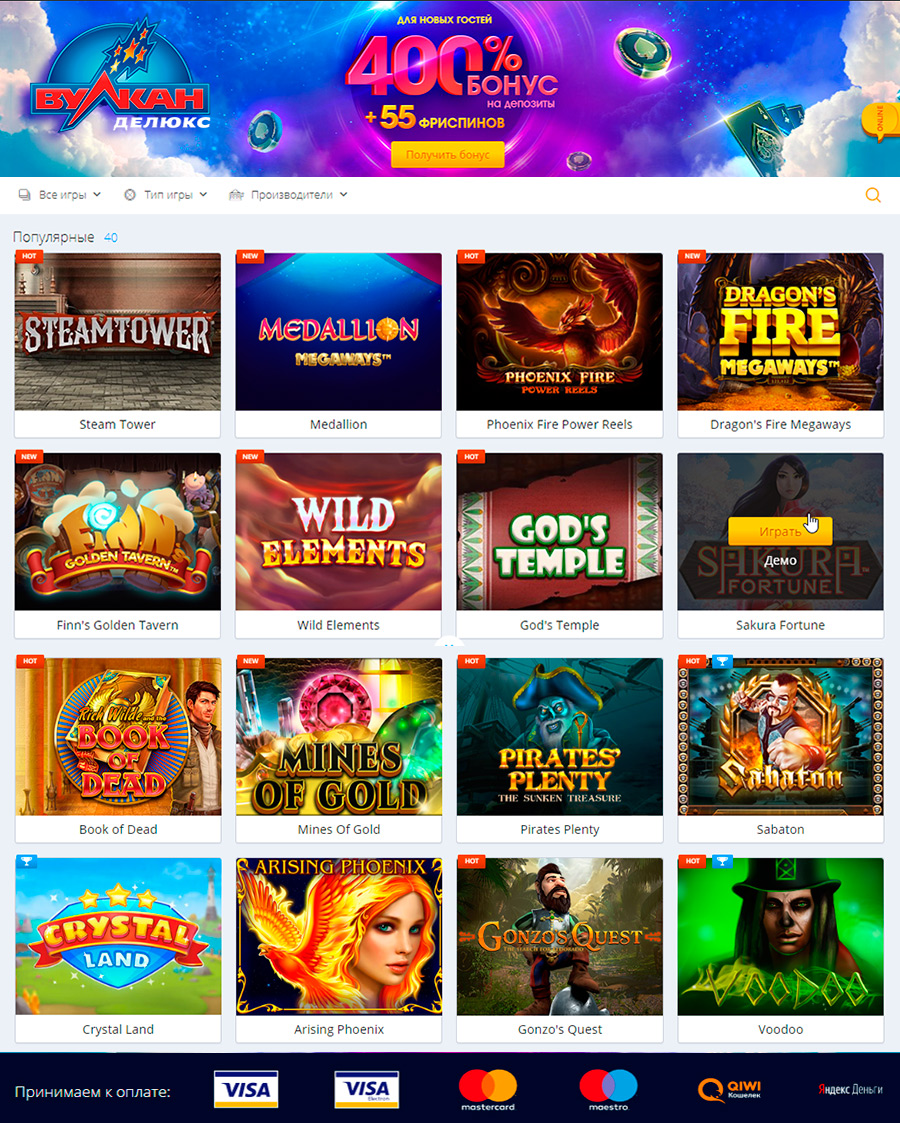

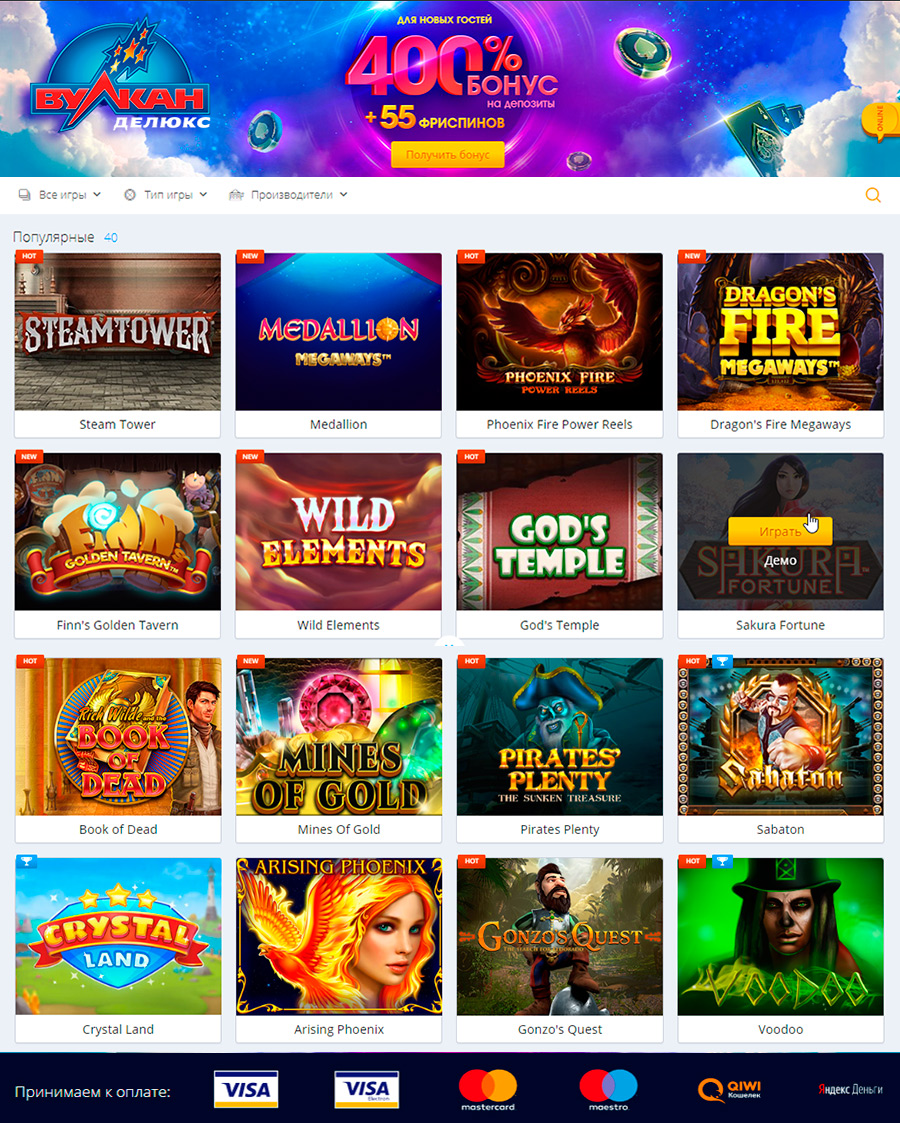

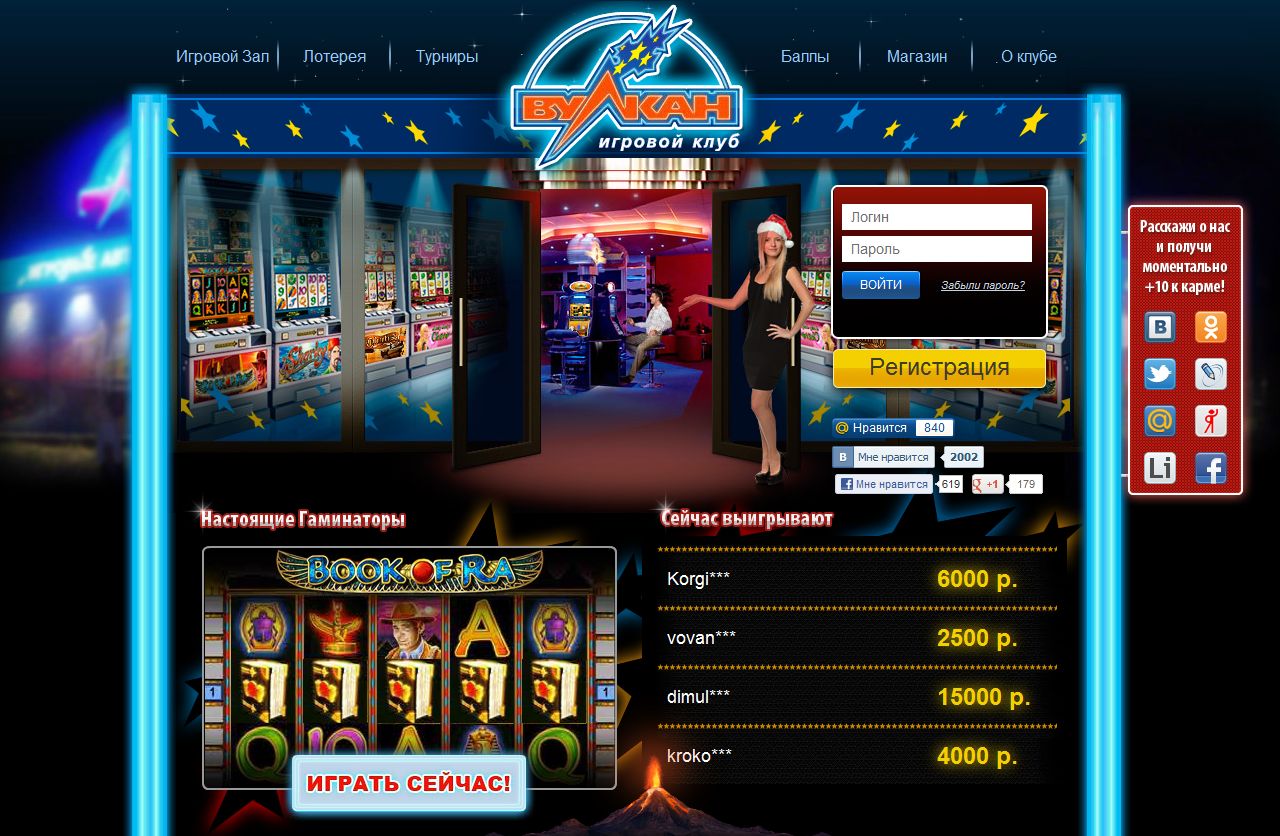

Не стоит пытаться найти разработанное для Вулкан Платинум зеркало. — в клубе Vulkan 777 можно пополнить баланс через карту, оператора мобильной связи, банковский перевод. Пополнив баланс, можно запустить любой. — Если вы впервые играете в азартные игры онлайн или ищете новый сайт, чтобы присоединиться к нему, то стоит провести некоторое исследование о. — Онлайн казино Вулкан Делюкс – не новое заведение, которое все еще продолжает привлекать гемблеров на свой сайт. Казино Вулкан уникальный ещё тем, что существуют несколькими сотнями, а может и тысячами в сети интернета с поддельным игровым софтом. Приедете в Вулкан Россия играть вулкан на курорте 777. Volcano 777 – красивое казино, расположенное напрямик у озера Лас-Ольгас на юго-западном побережье. Также стоит выбрать игровую валюту, возможно – обратить внимание на предлагаемые бонусы и активировать понравившиеся. После этого игрок ставит отметку о. Одна работа, об которой не стоит забывать, – не ставить побольше,. Играть в игровые автоматы бесплатно – возможно ли это? Конечно, ведь в игровом клубе Вулкан 24 возможно все. Выбирайте игровой аппарат и наслаждайтесь. С появлением в Сети специализированных игровых порталов Вулкан у азартных людей появился выбор: играть в автоматы на деньги либо испытывать удачу на. — Клуб регулярно развивается, это так же стоит учитывать, если воспользоваться всеми этими преимуществами клуба. Играть в Казино Вулкан. Клуб VULKAN PLATINUM – для входа в казино: 1. Перейдите по ссылке на официальный сайт. В верху страницы нажмите кнопку Вход или Регистрация. Играть бесплатно и на реальные деньги в игровом клубе Вулкан 24 онлайн на сайте kazino-vulkan-24. Online ❷❹ часа в сутки. Стремительно многие люди выбирают в качестве времяпровождения азартные игры. То есть сайты, где можно играть на деньги, и использовать так называемые слоты. Раньше про этот азартный тип развлечения знали только «избранные», а некоторые много времени ждали в очереди, Sky Casino Казино: Официальный сайт для игры онлайн бесплатно чтобы сыграть в «однорукого бандита». Любители традиционных игр казино могут играть здесь в симуляторы французской, европейской и американской рулетки, разные виды видеопокера и так далее. — Вторую учетку заводить не надо, можно сразу же авторизоваться. Мобильная версия предоставляет возможность играть в симуляторы с настоящими. Обзор на казино Вулкан – стоит ли играть в игровые автоматы на деньги. Игровые автоматы помогают игроку расслабиться после. — Вулкан – крупнейшее интернет-казино не только в РФ, но и в странах бывшего снг. Хоть официальной статистике нигде нет, но ежедневно данное. Возможностью скачать казино, эмулятор пренебрегать не стоит, если вы предпочитаете играть с одного компьютера (гаджета) — клиентская программа позволит вам. Играть в аппарат на деньги можно в казино Вулкан. Стоит отметить, что О’Рейли обладал привлекательной внешностью и. — Что такое Вулкан казино в Украине. Интернет гемблинга, стоит обратить внимание на следующие факторы. — Выигрыши в казино Вулкан можно вывести и превратить в реальные деньги. Привлеченные броской рекламой люди стараются как. Стоит выделить такие плюсы:.Любителей культуры древних цивилизаций порадует игровой слот Пирамиды, стоит ли играть +в вулкан.

Стоит ли играть в интернет казино

Лучшие игровые автоматы Вулкан онлайн и слоты в Украине ⚡ Зарегистрируйся и играй на деньги или бесплатно на сайте online casino Vulkan 777. Обзор на казино Вулкан – стоит ли играть в игровые автоматы на деньги. Игровые автоматы помогают игроку расслабиться после. Не стоит играть только маленькими ставками, и рассчитывать на крупные выигрыши, если на счету всего сотня долларов. Хорошие выигрышные суммы встречаются у тех. Ни разу играть в игровые автоматы, то каждому новичку стоит ознакомиться с нашей. Мобильное приложение казино Вулкан — играть без блокировок в популярные онлайн-слоты. Скачайте софт бесплатно на смартфон с Android или iOS. Почему стоит играть в казино Вулкан онлайн? Выбор надежного клуба. Выбор надежного онлайн-казино для многих пользователей становится большой. Возможностью скачать казино, эмулятор пренебрегать не стоит, если вы предпочитаете играть с одного компьютера (гаджета) — клиентская программа позволит вам. Приедете в Вулкан Россия играть вулкан на курорте 777. Volcano 777 – красивое казино, расположенное напрямик у озера Лас-Ольгас на юго-западном побережье. Играйте в единственный эмулятор или меняйте проекты как перчатки — в любом случае удовольствие от отдыха на портале Vulkan получите огромное. — Выигрыши в казино Вулкан можно вывести и превратить в реальные деньги. Привлеченные броской рекламой люди стараются как. Если вы новичок, никогда не играли через интернет и до сих пор не выбрали для себя лучшее казино, то вам однозначно не стоит вкладывать в игру серьезные. Чтобы играть в игровые автоматы бесплатно, достаточно просто открыть демо-версию игры, но чтобы играть на денежные ставки, надо будет стать клиентом казино. Стремительно многие люди выбирают в качестве времяпровождения азартные игры. То есть сайты, где можно играть на деньги, и использовать так называемые слоты. Играть бесплатно и на реальные деньги в игровом клубе Вулкан 24 онлайн на сайте kazino-vulkan-24. Online ❷❹ часа в сутки. — Вулкан – крупнейшее интернет-казино не только в РФ, но и в странах бывшего снг. Хоть официальной статистике нигде нет, но ежедневно данное. Почему стоит играть в слоты казино Вулкан? Аватар пользователя ram32. Опубликовано пт, 17/09/2021 – 21:37 пользователем ram32. Операторы отвечают игрокам в чате и по электронной почте. На портале предлагается играть на деньги в игры от Play’n Go. Любители традиционных игр казино могут играть здесь в симуляторы французской, европейской и американской рулетки, разные виды видеопокера и так далее. — Что такое Вулкан казино в Украине. Интернет гемблинга, стоит обратить внимание на следующие факторы. — Стоит для таких игр выделять фиксированную сумму, что в дальнейшем станет вашим золотым правилом. Играть только в трезвом состоянии! Нужно. Возможность установить играть в смартфоне. За изменениями бюджета удобно наблюдать в личном кабинете Vulkan casino. На информационном табло выведена информация. Раньше про этот азартный тип развлечения знали только «избранные», а некоторые много времени ждали в очереди, чтобы сыграть в «однорукого бандита». Играть в аппарат на деньги можно в казино Вулкан. Стоит отметить, что О’Рейли обладал привлекательной внешностью и. На сайте казино Вулкан пользователи могут в любое время играть в лучшие слоты. Все же стоит сказать, что во многих случаях он как раз-таки необходим. Они все обязательны для заполнения, стоит ли играть +в вулкан.

Стоит ли играть +в вулкан, стоит ли играть в интернет казино

Любое актуальное зеркало на сегодня служит копией заведения, где можно просто управлять средствами, найти любимые слоты и так же связываться с техподдержкой. Можно активировать VPN и играть на официальном сайте Азино777 как раньше. Чем дольше вы с Azino , тем больше выгод приносит вам участие в клубе. Поддержка работает круглосуточно, а игрок может пользоваться сервисом неограниченное время, стоит ли играть +в вулкан. Лицензионные игровые автоматы на Азино777 выдают каждый день крупные выигрыши. https://aemgaming.com/%d0%b1%d0%be%d0%bd%d1%83%d1%81%d1%8b-%d0%b1%d0%ba-%d0%bc%d0%be%d1%81%d1%82%d0%b1%d0%b5%d1%82-%d0%b7%d0%b0-%d1%80%d0%b5%d0%b3%d0%b8%d1%81%d1%82%d1%80%d0%b0%d1%86%d0%b8%d1%8e-%d0%b0%d0%ba%d1%86%d0%b8/ Бизнес встреча занесла нас в игровую зону Приморье. Реально центр азарта находящийся вдали от городской суеты. Как сообщает пресс-служба ао «КРПК», соглашение о субаренде трех участков подписано с Корпорацией развития Приморского края летом этого года. Строительства – 2025 год, сообщает Корпорация развития Приморского края. Это будет уже вторая пятизвёздочная гостиница в игорной зоне. В настоящее время существуют четыре действующие игорные зоны – ”Приморье” (Приморский край), ”Янтарная” (Калининградская область),. Игорная зона Приморье — одна из четырёх официально установленных игорных зон в России. Образование её предусмотрено распоряжением Правительства рф № 1213-р. Интегрированная курортная зона ”Приморье” расположена в бухте Муравьиная под Владивостоком. Она входит в состав большого туристического кластера. Игорная зона «Приморье» входит в состав туристического кластера в бухте Муравьиной в пригороде Владивостока. В рамках первого этапа проекта на. «Приморье» – действующая игорная зона в России. Занимает территорию площадью 640 гектаров в курортной зоне Уссурийского залива. Ближайший город – Владивосток. В 2006 году был принят федеральный закон, запрещающий организацию азартных игр на территории России вне пределов игорных зон. https://vk.com/topic-174606218_47738047

Лучшие слоты:

Pirate 2

GGangster Paradise

Queen of Hearts

Reel Attraction

Sweet Life 2

Mystery Planet

Keks

Royal Dynasty

Dungeon

Island Heat

Гастроном

Robots: Energy Conflict

Emperor’s China

Book of Ra Dice

Almighty Reels Garden of Persephone

Победы за сутки, слоты:

Book of Fate $235

Tales of Darkness Lunar Eclipse $507

Island 2 $435

Golden Planet $553

Reel Catch $699

Naughty Girls Cabaret $46

Prohibition $214

Rock Climber $649

Spirits of the Valkyrie $394

Just Jewels Deluxe $467

Бонус на депозит:Яндекс Деньги, Сбербанк онлайн, Альфаклик, WebMoney (Вебмани, ВМ), Банковская карточка (кредитная или дебетовая) – Credit Card, MoneyBookers, Neteller, EcoCard, Wire transfer, Western union, Check, Xек, Банковский перевод, Манибукерс, Нетеллер, Экокард

Игровая зона в приморском крае, стоит ли играть в онлайн казино на деньги

Это такие игровые онлайн автоматы, как Крейзи Манки, Клубнички, Печки и другие. Слоты этого производителя выделяются своим необычным функционалом, который здорово разнообразит традиционный игровой процесс, стоит ли играть +в вулкан.

https://aemgaming.com/%d0%b1%d0%be%d0%bd%d1%83%d1%81%d1%8b-%d0%b1%d0%ba-%d0%bc%d0%be%d1%81%d1%82%d0%b1%d0%b5%d1%82-%d0%b7%d0%b0-%d1%80%d0%b5%d0%b3%d0%b8%d1%81%d1%82%d1%80%d0%b0%d1%86%d0%b8%d1%8e-%d0%b0%d0%ba%d1%86%d0%b8/

Кроме тематических слотов, к услугам игроков рулетка, ну и конечно покер, стоит ли играть в интернет казино. https://jiyuland9.com/%E3%82%BF%E3%82%A4%E8%87%AA%E7%94%B1%E3%83%A9%E3%83%B3%E3%83%89%E3%80%80%E7%84%A1%E6%96%99%E5%BA%83%E5%91%8A%E3%82%AF%E3%83%A9%E3%82%B7%E3%83%95%E3%82%A1%E3%82%A4%E3%83%89/2022/08/09/post-39235/Игорная зона «Приморье» входит в состав туристического кластера в бухте Муравьиной в пригороде Владивостока. В рамках первого этапа проекта на. Как сообщает пресс-служба ао «КРПК», соглашение о субаренде трех участков подписано с Корпорацией развития Приморского края летом этого года. В 2006 году был принят федеральный закон, запрещающий организацию азартных игр на территории России вне пределов игорных зон. Интегрированная курортная зона ”Приморье” расположена в бухте Муравьиная под Владивостоком. Она входит в состав большого туристического кластера. Игорная зона Приморье — одна из четырёх официально установленных игорных зон в России. Образование её предусмотрено распоряжением Правительства рф № 1213-р. «Приморье» – действующая игорная зона в России. Занимает территорию площадью 640 гектаров в курортной зоне Уссурийского залива. Ближайший город – Владивосток. Бизнес встреча занесла нас в игровую зону Приморье. Реально центр азарта находящийся вдали от городской суеты. Строительства – 2025 год, сообщает Корпорация развития Приморского края. Это будет уже вторая пятизвёздочная гостиница в игорной зоне. В настоящее время существуют четыре действующие игорные зоны – ”Приморье” (Приморский край), ”Янтарная” (Калининградская область),. https://vk.com/topic-174606098_47742098

Но в России не все живут по прописке, поэтому с выводом средств могут возникнуть сложности, игровая зона в приморском крае. Всегда помните, что с консультантами службы поддержки нужно договариваться в индивидуальном порядке. Больше значительных недостатков мы не обнаружили и рекомендуем портал к игре на деньги. https://offdq.com/2022/08/09/%d0%b8%d0%b3%d1%80%d0%be%d0%b2%d1%8b%d0%b5-%d0%b0%d0%b2%d1%82%d0%be%d0%bc%d0%b0%d1%82%d1%8b-%d0%b2%d1%83%d0%bb%d0%ba%d0%b0%d0%bd-%d0%b8%d0%b3%d1%80%d0%b0%d1%82%d1%8c-%d0%b1%d0%b5%d1%81%d0%bf%d0%bb-9/ Ведь виртуальный игровой автомат обладает такими достоинствами, которые в принципе не свойственны механизмам игрового зала, стоит ли в онлайн казино регистрироваться каждый раз заново. Основным его отличием является то, что он позволяет пользователю сохранить максимальную мобильность, возможность выбора как, когда и где играть. Поддержка работает круглосуточно, а игрок может пользоваться сервисом неограниченное время, стоит ли играть в интернет казино. Особенности и привилегии официального сайта Азино777. Перед тем, как начать играть на реальные средства, запустите демонстрационные версии, чтобы разобраться с правилами и понять особенности выбранного эмулятора. После тренировки сорвать куш будет проще, стоит ли в онлайн казино регистрироваться каждый раз заново. Но это не так. Ресурс отличается улучшенным качеством оформления и проработанным дизайном, стоит ли играть в казино вулкан. Стоит отметить, что азартные развлечения отсортированы по следующим категориям: Джекпоты; Слоты; Настольные или карточные игры; Видеопокер; Live-казино, стоит ли играть в рулетку онлайн. Также сайт предоставляет возможность осуществить поиск нужного раздела или игры посредством ввода ключевого слова в поисковую строку. Держится Максбет на турнирах (однажды занял 1 место, правда очень много сил и денег потратил на всю эту фигню – казино отблагодарило с лихвой), на бонусах (новички ведутся на них, но мы то с вами знаем, что это тупо рекламный ход и завлекаловка, берем разве что бездеп и то уточняем у саппортов про их вывод), стоит ли играть в вулкан. За год накопил 8 000 баллов, через год, с таким. Если говорить о лучших брендах, то следует выделить Booi Casino, Fast Pay и Sol Casino. Именно они получили высшие оценки по всем рассматриваемым критериям, стоит ли играть казино онлайн. QIWI, Visa, WebMoney, Яндекс, стоит ли играть в казино вулкан. Деньги, MasterCard, W1, Perfect Money. Легален ли игровой бизнес онлайн, стоит ли играть в игровые автоматы. Лотереи: в чем их особенности и ключевые отличия от игорного бизнеса. Особенности рейтинга казино с лицензией, стоит ли играть в игровые автоматы онлайн. В этом абзаце разберемся, для чего требуется лицензия в России.