EnglishLearning

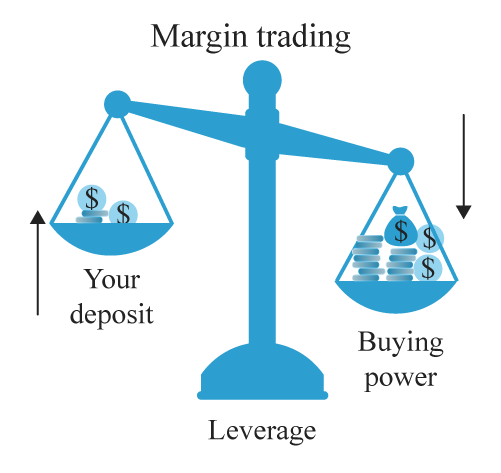

Thus, in an economic downturn, their profits may sink due to increased fixed costs and decreased sales. The textbook definition of ”leverage” is having the ability to control a large amount of money using none or very little of your own money and borrowing the rest. It is very tempting to trade in a larger size than what was originally determined if you have a streak of winning trades. A corporation that borrows too much money might face bankruptcy or default during a business downturn, while a less leveraged corporation might survive. Leverage is a key feature of CFD trading and can be a powerful tool for you. But what happens if the price of BTC drops 20%. Investors can also use leverage in their investment strategy – borrowing money to invest, can magnify investment returns. If the company’s interest expense grows too high, it may increase the company’s chances of a default or bankruptcy. There is a massive difference between what is leverage trading crypto like if you’re going for margin, and how it works with perpetual contracts. Already Stock trading spreads widely have an account. Debt to Equity Ratio = Liabilities / Stockholders’ Equity.

What is leverage ratio?

Most of a company’s costs are fixed costs that recur each month, such as rent, regardless of sales volume. One of the reasons so many people are attracted to trading forex compared to other financial instruments is that with forex, you can usually get much higher leverage than you would with stocks. Devlin is back as executive producer with, Rogers and Downey acting as consulting producers in the new iteration. With City Index, your margin rates per market will vary – so a forex margin rate will be different from an oil margin rate. The Debt to EBITDA ratio is similar to the net leverage ratio. 18 Soho Square, W1D 3QH, London, UK. Pro tip: A portfolio often becomes more complicated when it has more investable assets. They borrow money and invest it on the capital market or in other assets e. For example, while it’s easy to increase possible payouts with is, it’s equally simple to make losses more damaging the same multiplication rate is applied to both payouts and losses. The equity multiplier is also a component of the DuPont analysis for calculating return on equity ROE. 6,00,000, leading to a loss of Rs. There are different leverage ratios such as. John Rogers, the co creator of the original Leverage, will serve as showrunner and executive producer for the third installment. The one risk that runs while using leverage is the loss that the companies might face if the asset value declines and goes lower than the interest that the companies have to pay on their debts. Read the Privacy Policy to learn how this information is used.

Leverage Ratio

TV Show has 29 episodes in 2 seasons shown every Wednesday at 12 am. It can mean that earnings will be inconsistent, it could be a while before shareholders can see a meaningful return on their investment, or the business could soon be insolvent. Simply put, it’s borrowing money to make more money. The point and result of financial leverage is to multiply the potential returns from a project. You can find out more about our use, change your default settings, and withdraw your consent at any time with effect for the future by visiting Cookies Settings, which can also be found in the footer of the site. During the 1990s, investors marveled at the nature of its software business. Their reviews hold us accountable for publishing high quality and trustworthy content. For that reason, leverage trading is risky and you should consider whether you can afford to lose your entire position. You can find lists of high yield deals online in various sources; the best sites change periodically, so we’re not linking to anything specific here, but you can find quite a few examples with simple searches. Operating Leverage = Sales – Variable Costs / Profits. For example, a company with earnings before interest and taxes of $20 million and interest expense of $5 million would have interest coverage of 4 times. That’s to say, operating leverage appears where there is a fixed financial charge interest on debt and preference dividend. Normally lead to a reduction in its fixed assets turnover ratio. It’s anything that could be sold for money. 16 on Amazon Freevee. It shows the company’s overall debt burden. That means for every $1,000 you invest, you can make forex trades worth $30,000. 600000 consisting of 6000 shares of Rs. Debt to EBITDA ratio = Total debt / EBITDA x 100. Let’s look at two companies, one who has higher variable costs and is using labor to create a product, and a second company who purchased an expensive piece of equipment to automate their manufacturing process. The level of capital is important because banks can ”write down” the capital portion of their assets if total asset values drop. We’re still in a space of editing and all that. HODGE: That’s the thing, I don’t even wait. More expensive than other types of trading. The variable costs for manufacturing one product amount to $0. Rather, it reduces the amount of trading capital that must be used, thereby releasing trading capital for other trades.

Putting It All Together

Abdullah Al Ghamdi joined Screen Rant in 2019. A new iteration of ’Leverage’, the show follows Sophie the grifter, Parker the thief, Eliot the hitter, and Alec the hacker, who have watched the world change since their last job eight years ago. The following lists contain the most common methods to analyze the leverage risk of a company, aside from the financial leverage ratio. I suppose if your very tall you might find that somewhat uncomfortable. Next, the percentage change in the EBIT values and the percentage change in the sales figures are calculated as. The term ’advantage’ has a mix of origins, including the Old French avant, which means ”in front. Looks like something went completely wrong. The cash flow variation is arguably a more practical approach in thinking about the financial risk of a company since you’re comparing two off setting factors. Similarly, a debt to equity ratio greater than 2 would also be considered high. 7B in Green Bonds Support Innovative Green Technology. This involves deciding the maximum amount that you are willing to lose. The practice of borrowing money to increase potential returns. AG James Hodgins1 episode, 2022. Luke Stewart1 episode, 2022. In some cases, you may choose to borrow money to make a larger investment. This means that a 10% increase in sales will yield an 11% increase in profits 10% x 11 = 110%, but the company generates $1,527,000 more in sales revenues 8,964,000 7,437,000 = 1,527,000. After its fixed development costs were recovered, each additional sale was almost pure profit.

Divide your Positions

It did not require capital for all off balance sheet risks there was a clumsy provisions for derivatives, but not for certain other off balance sheet exposures and it encouraged banks to pick the riskiest assets in each bucket for example, the capital requirement was the same for all corporate loans, whether to solid companies or ones near bankruptcy, and the requirement for government loans was zero. Cash Accounting, How Automation of Sales and Purchase Register Has Helped Businesses, How to Write Business Plan, Arm’s Length Transaction, Data Synchronisation, Microenterprise, Contingent Liabilities, Convenience Vs Security, 4 Technology Trends which can Reduce your Business Woes, MSME Registration, Best E commerce Practices for Small Businesses, Key Things to Keep in Mind While Taking a Business Loan, Crowdfunding: Smart funding for SMBs, How the Startup Culture is Impacting the Indian Economy, Digital Marketing and its Advantages to Boost the MSME Sector in India, Tips for a Small Business to Survive the Crisis. When home prices fell, and debt interest rates reset higher, and business laid off employees, borrowers could no longer afford debt payments, and lenders could not recover their principal by selling collateral. A lower financial leverage ratio is usually a mark of a financially responsible business with a steady revenue stream. So, in our previous example, the potential for loss is also limited to the $1000 you paid for the position. Your browser doesn’t support HTML5 audio. Other leverage limits include. Below are three formulas to calculate the DOL based on available information. Of the many firms associated with LBOs, such as The Carlyle Group, The Blackstone Group, and the now defunct Forstmann Little and Company, one of the most well known is the New York City based private equity firm Kohlberg Kravis Roberts and Co. It is possible to buy Bitcoin with borrowed money, make a profit, and then return the borrowed money for very large profits. Your AMC Ticket Confirmation can be found in your order confirmation email. From the man who created an opioid crisis from the comfort of his boardroom to the shadowy security firm that helps hide dangerous secrets for a price – when someone needs help, they provide. Leverage is widely used in business, investing, and even personal finance. The lesson sequence focuses on: 1 helping students learn relevant background knowledge, 2 explicitly teaching social studies reading strategies and giving practice with those strategies, and 3 explicitly teaching argumentative writing strategies and giving practice with those strategies. How does trading leverage work. They also reduce the overall leverage for certain assets when they expect a major market moving news. Our results show that credit default swap spreads on the 5 year subordinated debt of LR banks fell relative to non LR banks post leverage ratio introduction. Effectively, they view leveraged buyouts as a ”no money down” acquisition. In fact, beginner investors lost more than $774 million in one five week period during 2020, which also resulted in over 15,000 accounts going into negative balance, owing $10. The senior debt ratio is important to track because senior lenders are more likely to place covenants – albeit, such restrictions have loosened across the past decade i. E ’ = max 0 , ∑ Ei − ∑ Ci. The banking suite simplifies invoice tracking, scheduling of payments, paying taxes, applying for loans, and viewing financial reports for businesses.

.jpeg)

Learning about students

Not many people have enough cash to buy a house or investment property outright, so they use leverage. John Rogers serves as showrunner and executive producer. 2018, promoting certification Gehman and Grimes, 2017, strengthening of CBCs’ sense of distinctiveness Grimes et al. 5 of his capital, and if he has 50% of this used margin in equity, i. Where Total Debt service is the current debt obligations that a company owes. Certified fresh picks. This is expressed as. The ”multiplier” number represents the number of times you can leverage each unit of currency. Using leverage for personal finances: While leverage is often associated with investing, individuals also use leverage to make big ticket purchases. The proposed investment is expected to give a return of 20% per annum i.

Indices

Comparably, if the asset depreciates by 30%, the asset will be valued at $70,000. Keep reading to learn more about how to calculate leverage ratios and what they mean for your business. Careful planning is needed. Financial leverage creates new opportunities for business owners and investors to invest. Operating leverage is a helpful cost accounting tool you can use to set prices and ensure you’re breaking even each month. However, if the cost of debt is kept lower than the profit or revenue generated, it positively impacts the business. Instead of being limited to only the $5 million from investors, the company now has five times the amount to use for the company’s growth. Only using a 1:25 ratio of leverage results in a +$2500 when the underlying asset moves 20% in your direction. Do not sell my personal information CCPA. Grace Bradford Wilson1 episode, 2021. See why serious traders choose CMC. I would love to learn one day, so this leverage is less useful to me. 3%, which is known as 30:1 leverage. The market beta strategy is similar to market timing in that the investor implementing the strategy is relying on market forces—rather than changes at the asset level—to drive returns. Season 2 guest stars include Pierson Fodé, Alanna Masterson, Anand Desai Barochia, Steve Coulter, and Doug Savant. Another great offering that sets apart RazorpayX from all its competitors is the Forex funding facility. The goal is to have the return on those assets exceed the cost of borrowing funds that paid for those assets. This connection may be general or specific, or the words may appear frequently together. For example, a forex leverage ratio of 100:1 would mean that for every £1 they put in, they get £100 worth of exposure. Most business owners won’t need to use this ratio because they don’t have exploration costs. Change in Sales = Sales current year – Sales previous year / Sales previous year. One of the primary risks of leverage trading is the fact that it amplifies your potential losses, potentially to the point where you can lose more money than you have available. As expected, each of the ratios increases as a result of the sub par performance of the company. The term leverage is used differently in investments and corporate finance, and has multiple definitions in each field. If a company can generate higher return rates than the interest rates and repayments on its loans, the debt might be a useful tool for growth. This means that a 10% increase in sales will yield a 12% increase in profits 10% x 11. Keep up with your favorite shows. Department of Education, Office of Special Education Programs, Award No. The company may also experience greater costs to borrow should it seek another loan again in the future. They bet on the growth or fall of the underlying asset, which in this case is the currency against the quoted currency.

Kraig Dane

Here are some examples of what financial leverage ratios can look like in practice. Financial leverage is a key concept for stock traders and investors to grasp when evaluating a company’s fundamentals. Here are the different ways you can use leverage to trade in stocks. Terms of Service Data Privacy Statement Legal notice. Your browser doesn’t support HTML5 audio. If you choose the latter and open a margin trading position, you’ll have leverage – 2x leverage, to be exact. The bonds in this type of deal are often not considered investment grade because of the amount of risk involved. Cookies are files stored in your browser and are used by most websites to help personalise your web experience. Following the hype can be effective in the short term. The Squat is the ultimate exercise for building mass and strength in the thighs, glutes, calves, and lower back. Positive leverage indicates the company is generating sales over total costs. There is an implicit assumption in that account, however, which is that the underlying leveraged asset is the same as the unleveraged one. Set Designer 16 Episodes. This tells you that, for a 10% increase in sales volume, ABC will experience a 25% increase in operating profit 10% x 2. After you have verified your identity you are ready to make a deposit. But when it comes to safeguarding the financial stability of the banking system, it might be prudent to try and guard against this. Financial leverage follows the straightforward definition of leveraged discussed so far. The debt to EBITDA ratio analyses the relationship between a company’s debt and its earnings before the impact of depreciation and amortization. Operating income is equal to sales minus variable costs and fixed costs. The authorities can always impose different speed limits on other roads depending on risk, and the same is true through the combination of the leverage ratio and the risk based requirement.

Education

4 BTC at $20,000, based on a $50,000 market price. ” The students themselves should have a role in setting classroom rules and routines. Whereas losses incurred from the investment can sour the whole investment. Risk comes with the territory—it’s never guaranteed that your investment will lead to financial gains. It is the squat; any personal trainer or other professional will tell you what a necessary exercise this is to achieve and maintain tone and strength in the legs. Operating leverage refers to the degree to which fixed costs are present in a company’s cost structure. First Prudential Markets Ltd registered address is 135 Omonoias, UAD Court, 7th Floor, 3045 Limassol, Cyprus. We strive to empower readers with the most factual and reliable climate finance information possible to help them make informed decisions. This is considered to be one of the more meaningful leverage ratios available.

Manage My Account

Total Debt= Short/Long Term Borrowings, Bonds and Debentures. Imagine a business with the following financial information. Beyond the guarantee for the difference to the underlying security or cash in the transactionFootnote 28, a further exposure equal to the full amount of the security or cash must be included in the exposure measure. Similarly, we can conclude the same by realizing how little the operating leverage ratio is, at only 0. A higher debt to asset ratio means that a business is more heavily reliant on borrowed funds. In conclusion, in general it is better to have a lower debt to equity ratio, however, there are certain circumstances where it is not always the case. ”Reformed criminals put their unique skills to good use by helping ordinary people fight back against corporate and governmental injustices. This is because your total profits to be paid to you or losses – to be paid by you – are calculated on your full position size, not your margin amount. You may unsubscribe from these communications at any time. This decreases overall profitability. Sandbox WorkspaceLondon Bridge,46 48, Red Lion Court, Park St,London SE1 9EQ. JOIN THE NEXT STRATEGIC CFO™ WORKSHOP SERIES. However, many leverage trading platforms make it possible to profit even when the market is declining. Via the tax consolidation regime. The team needs to sneak into an e sports tournament to put an end to the abuse of a team owner to his players.